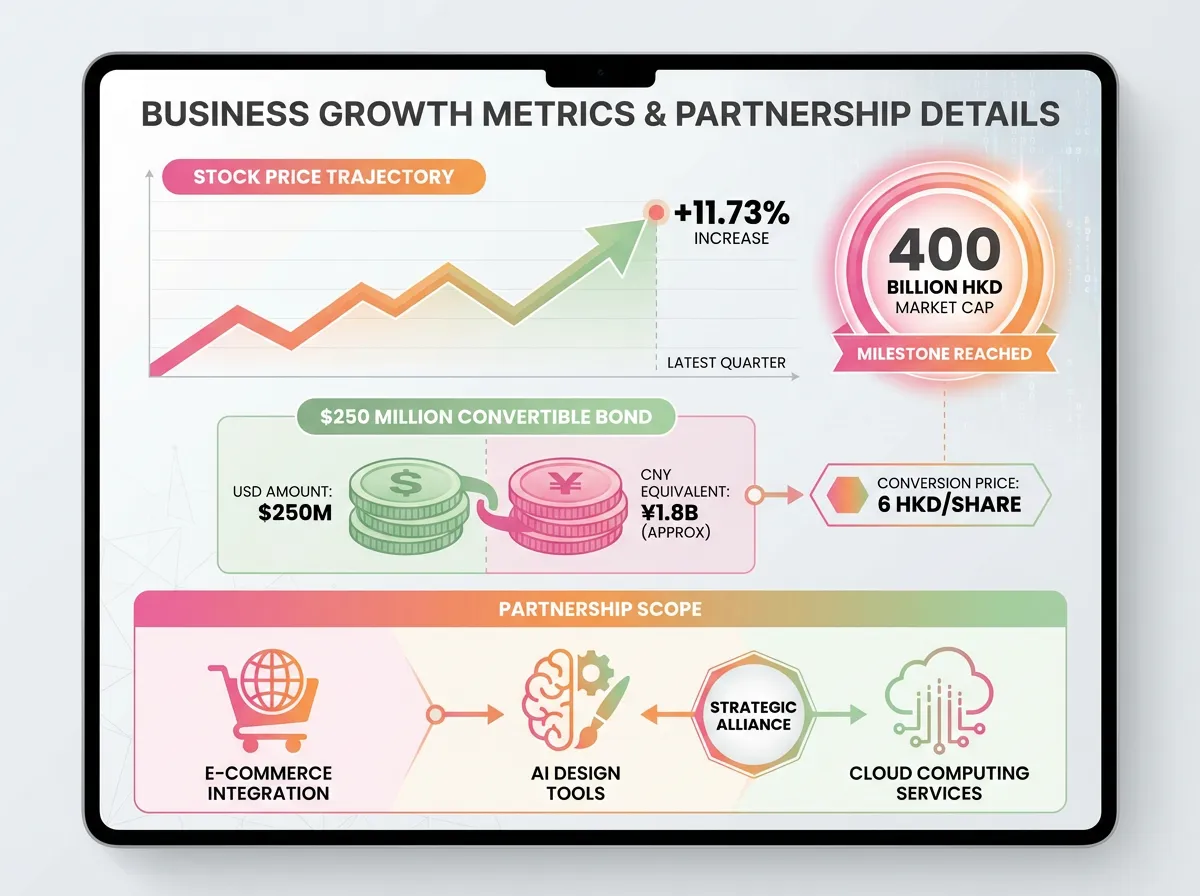

On January 12, 2026, the digital application sector of the Hong Kong stock market rose across the board, with Meitu Corporation performing particularly well. On that day, the stock price surged 11.73%, closing at HKD 8.86 per share, and the total market value officially exceeded the HKD 40 billion mark. Behind this strong performance is the $250 million convertible bond delivery completed with Alibaba, as well as the market confidence boost brought by the rapid expansion of AI driven design and productivity tools business.

The delivery of 250 million US dollars convertible bonds has been completed, and the two giants have started deep cooperation

Meitu Corporation announced on December 31, 2025 that the $250 million convertible bond agreement signed with Alibaba has met all prerequisites and completed delivery. According to the terms of the subscription agreement, Meitu has issued convertible bonds with a total principal amount of 250 million US dollars (approximately 1.8 billion RMB) to Alibaba, which can be converted into Meitu stock at a price of 6 Hong Kong dollars per share. If fully converted, Alibaba will hold approximately 6.82% of Meitu's shares.

This capital injection not only brings abundant cash flow to Meitu, but also marks the official start of strategic cooperation between the two tech giants. According to the agreement, both parties will engage in comprehensive cooperation in areas such as e-commerce, automated design tools, and large-scale cloud computing architecture. Meitu and Alibaba plan to deepen the alignment of logical intentions and the construction of reasoning capabilities in travel and e-commerce scenarios, promote the large-scale implementation of automated interactive systems in more complex business processes, and explore new paths for the commercial application of AI technology.

The commercialization of AI design tools is accelerating, and user payment rates continue to rise

Bank of America Securities pointed out in its latest industry analysis report that the monetization process of digital productivity tools is accelerating. The design and productivity business under Meitu is rapidly expanding driven by automation functions, and the user payment rate is expected to continue to increase, with strong profit growth momentum in the future. The report suggests that despite concerns about competition in general computing architectures, the deep alignment between the trend of software localization and vertical industry demand makes the software market outlook for 2026 cautiously optimistic.

Meitu's layout in the field of AI design tools has achieved significant results. According to previous financial report data, Meitu's revenue in the first half of 2025 reached 1.8 billion yuan, a year-on-year increase of 12.3%. Among them, the revenue from imaging and design products was 1.35 billion yuan, a significant year-on-year increase of 45.2%. The number of paying users has exceeded 15 million, with a net profit of nearly 400 million yuan, a year-on-year surge of 30.8%. The core product "Meitu Design Studio" is a design tool specifically designed for e-commerce practitioners, with a monthly active user base of 17 million and monthly paying users of 930000. In 2023, its single revenue has exceeded 100 million yuan.

Software localization substitution and deep integration of vertical scenes

The success of Meitu's AI design tool lies in accurately capturing the pain points of vertical industries. The contradiction between the explosive growth of design demand and the shortage of professional designer resources is becoming increasingly prominent in content intensive scenarios such as e-commerce, social media, and advertising marketing. Meitu has greatly reduced the design threshold and cost through AI automation design functions, enabling ordinary users to quickly generate professional level visual content and effectively filling the market gap.

Industry analysis suggests that AI image design tools can reduce costs by 50% -80% in various aspects of graphic design. If the market penetration rate reaches 40% -70%, the market size of AI image+graphic design is expected to be between 4.7 billion and 20.8 billion yuan. As a pioneer in this field, Meitu has established a complete barrier from tools to ecology. With the deep cooperation with Alibaba in the e-commerce scene, it is expected to further expand its market share and consolidate its leading position in the industry.

Capital markets regain favor, valuation system restructuring underway

Since the end of 2024, Meitu's stock price has continued to strengthen, rising from HKD 2.86 to the current HKD 8.86, with a cumulative increase of over 200%. Its market value has grown from over HKD 20 billion to over HKD 40 billion. This performance not only reflects the market's recognition of Meitu's AI business prospects, but also marks the successful transformation of this former "last era company" in the AI wave.

Compared to the 250% surge in the first day of listing of graphic editing software Figma, there is still significant room for improvement in the market value of Meitu. But unlike the simple valuation logic of tool software in the past, Meitu is building a comprehensive platform with AI as the core, covering design tools, content ecology, and e-commerce scenarios. The strategic cooperation with Alibaba not only brings financial and technological support, but also opens up vast market spaces such as e-commerce and cloud computing, providing solid support for the restructuring of the valuation system.

The successful transformation of Meitu provides a sample for traditional Internet tool enterprises to embrace AI technology and open up the second growth curve. Under the trend of software localization and deep integration of vertical scenarios, enterprises with core technology accumulation and user base are expected to occupy a favorable position in the AI commercialization wave, achieving a transition from tools to platforms, and from traffic to payment in business models.